Disclosure Management at PlanPulse is about ‘disclosing’ information regarding your organisation and an important part of your financial, management or statutory reporting . It ensures that the organization complies with legal regulations and maintains transparency with stakeholders. As a process, is also known as the “last mile of finance”, where all steps in the financial processes – financial close, variance analysis, and re-forecasting – are all key ingredients in what is reported to external stakeholders.

This means that the internal information will be reported externally including all comments and explanations and ideally with the help of a clear workflow with tasks and responsibilities. Within the solution of our partner Board this can be done in one platform that is integrated with windows tools like excel, word and powerpoint.

Some examples of ‘Disclosure Management’ PlanPulse is supporting with Board International:

Lease Accounting / IFRS 16. Lease accounting refers to the set of rules and guidelines used to record and report lease transactions in financial statements. It includes identifying, measuring, and showing leases according to accounting rules like IFRS or GAAP. Under GAAP, leases are classified as either finance leases or operating leases.

Annual Report: As part of disclosure management, PlanPulse supports customers in creating a fast, and reliable annual report including tables, graphs, comments and workflow including direct and real time connections to solutions like Excel, Word and Powerpoint.

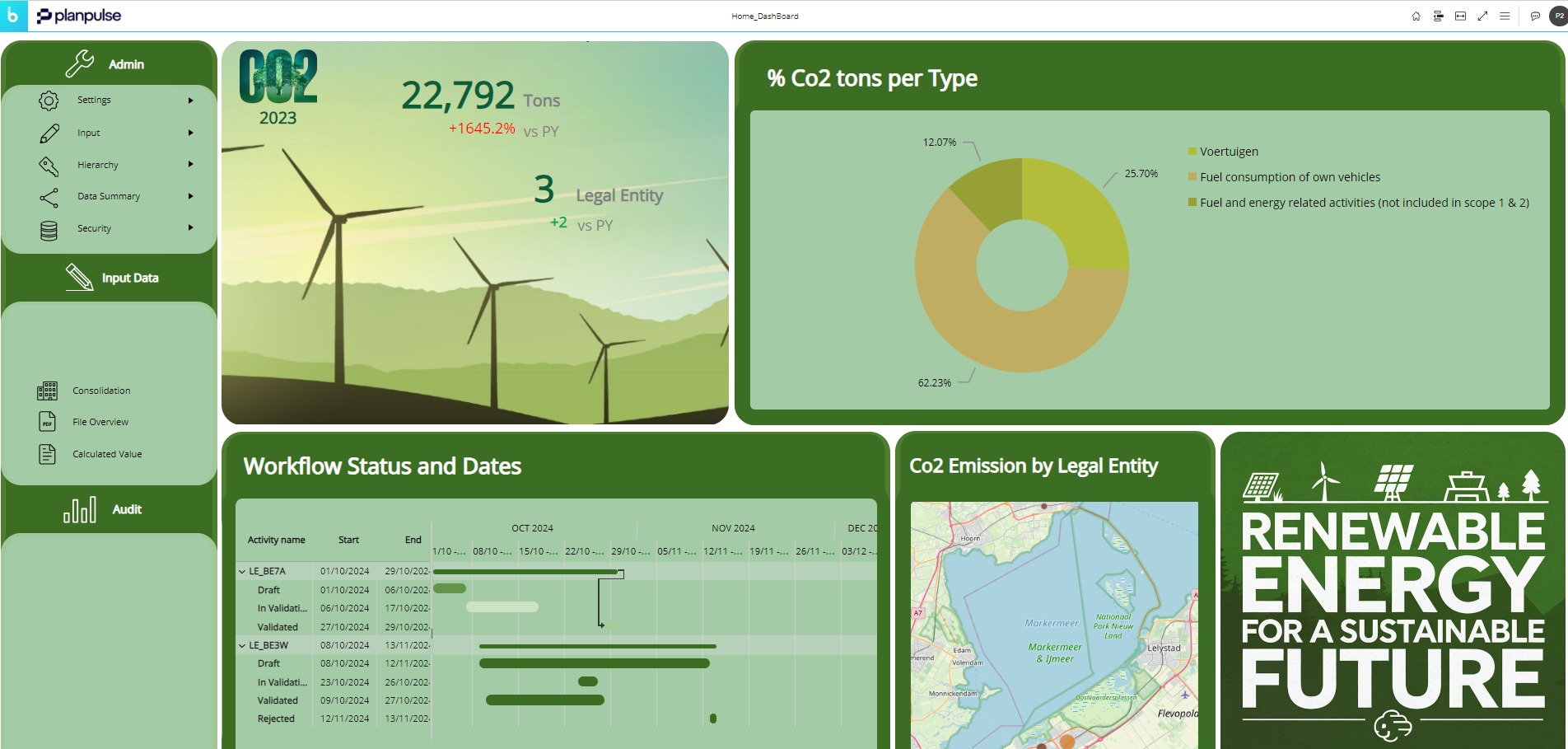

ESG Reporting: Environmental, social and governance (ESG) considerations are driving a complete reframing of how we measure value. It’s more than legal compliance, more than ticking boxes. Investors, consumers, employees, suppliers and other stakeholders are putting pressure on organisations of all types to put sustainability at the heart of business. We have multiple customers that have added ESG and CSRD to their EPM integrated solution, like Van Moer Logistics and Colruyt Group. Read the cases to learn more or contact us for more information about Disclosure Management at PlanPulse.